ny paid family leave tax code

Each year the Department of Financial Services sets the employee contribution rate to match. The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages.

Paid Family Leave For Family Care Paid Family Leave

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or.

. Paid Family Leave provides eligible employees job-protected paid time off to. If the Suppress option 154-07 Suppress NY Paid Family Leave is selected at the PSID-level on the Payroll Service ID page under Payroll Options State Taxability section the. Vacation and Personal Leave.

The check box on the uncommon situations screen is for PFL benefits that you received that are included in your W-2. New York State Department of Labor - Unemployment nygov. 67 of the employees average weekly wage or 67 of the statewide average weekly wage whichever is less.

The New York State Department of Financial Services has announced the contribution rate and benefit schedule under the New York Paid Family Leave PFL law effective January 1 2021. As of January 1 2021 must provide up to 56 hours of paid safe and sick leave if the employer employs 100 or more. September 2020 Business Due Dates Due Date Business Income Tax Return New York Paid Family Leave.

W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages. In 2023 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap.

They are however reportable as. New York Paid Family Leave is insurance that is funded by employees through payroll deductions. Paid Family Leave may also be available.

Solution found The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll. Your premium contributions will be reported to you by your employer on Form W-2 in. Employers may offer employees the.

What category description should I choose for this box 14 entry. Starting January 1 2023 the Paid Family Leave wage replacement benefit is increasing. The NYPFL in box 14 is PFL tax that you paid.

Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions. Ny paid family leave tax code Sunday March 20 2022 Edit. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave.

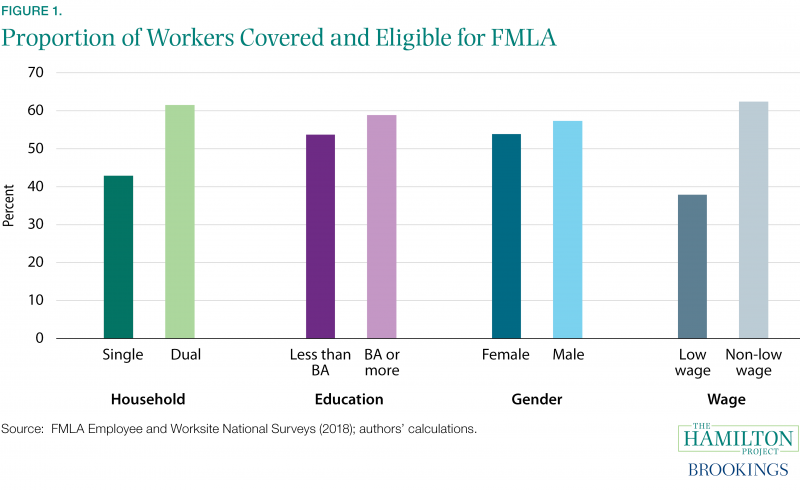

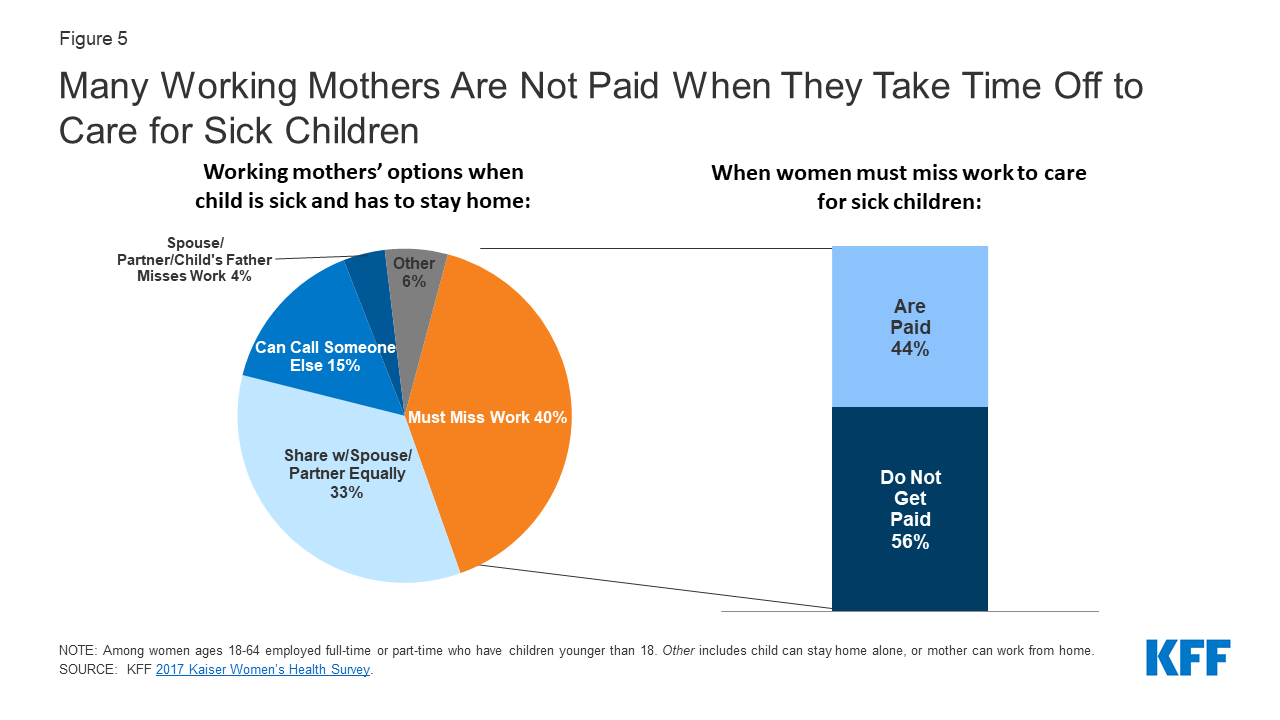

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

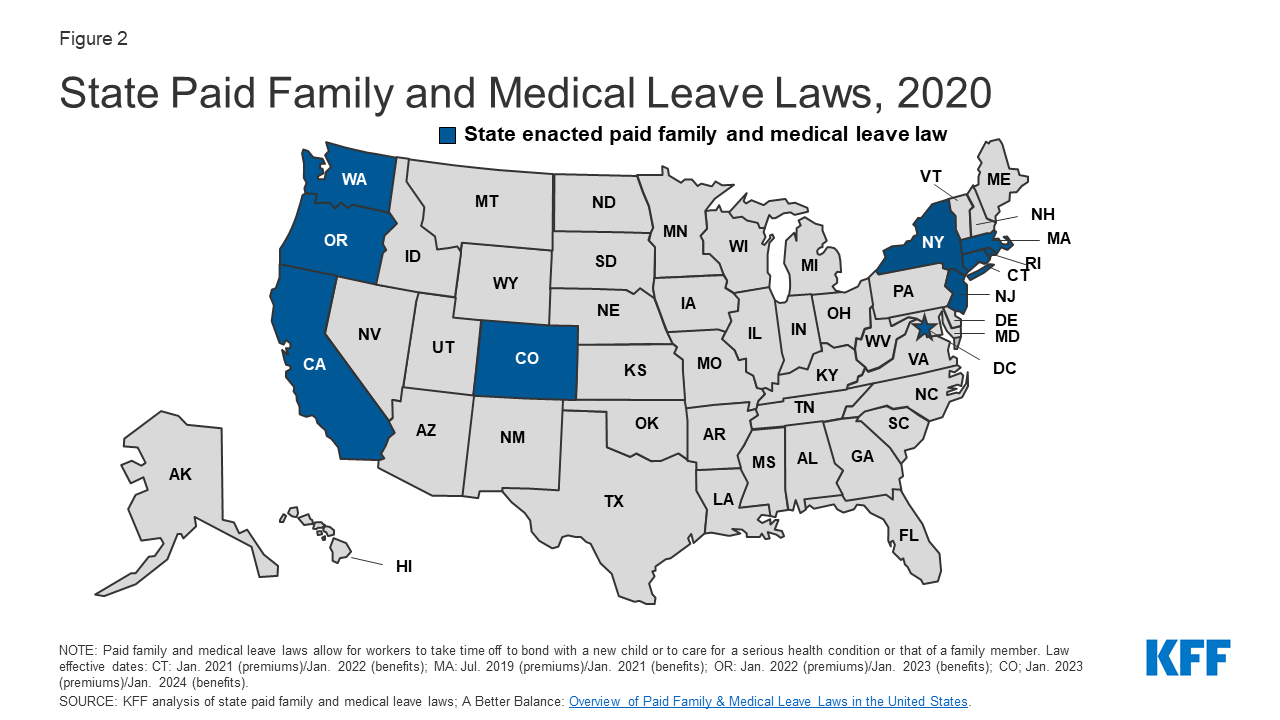

A Proposal For A Federal Paid Parental And Medical Leave Program The Hamilton Project

New York State Paid Family Leave Law Guardian

New York Paid Family Leave Ny Pfl The Hartford

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

2021 State Paid Family And Medical Leave Contributions And Benefits Mercer

Why We Talk About Paid Family Leave In Only Economic Terms Time

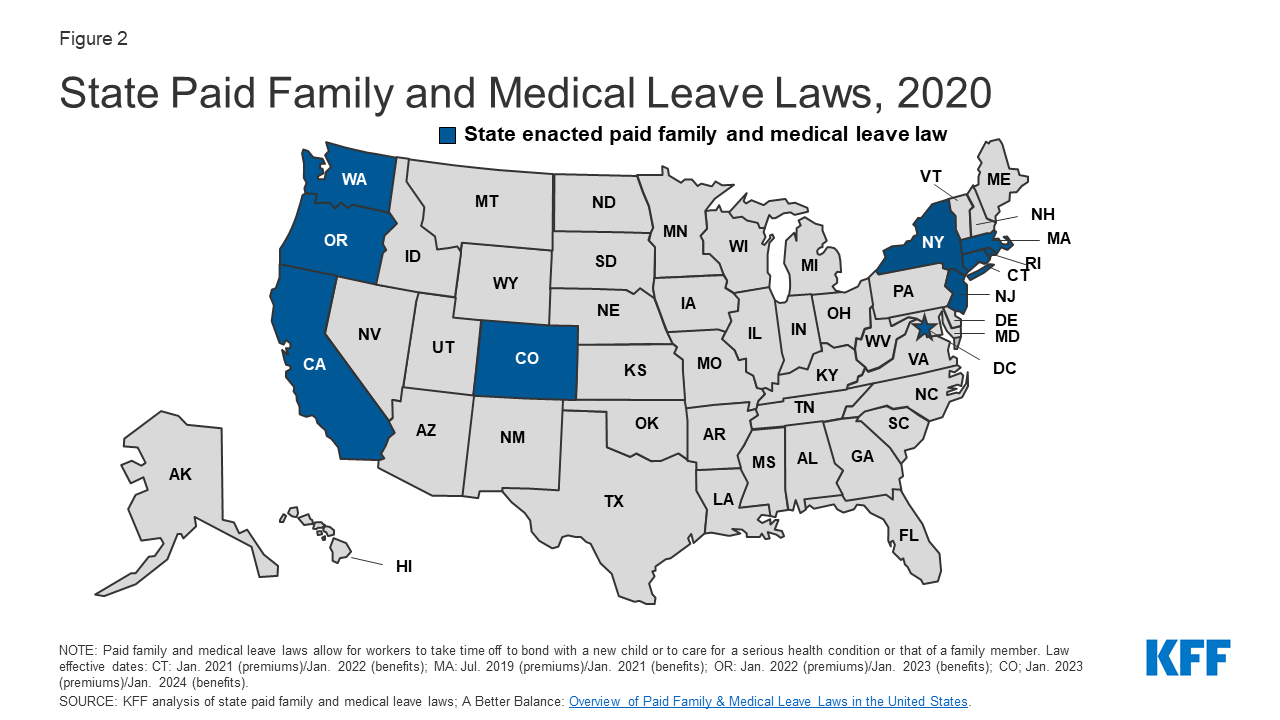

Universal Paid Family And Medical Leave Under Consideration In Congress Kff

New York State Paid Family Leave Cornell University Division Of Human Resources

Paid Family Leave For Family Care Paid Family Leave

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Paid Family Leave For Family Care Paid Family Leave

Cost And Deductions Paid Family Leave

Paid Parental Leave Around The World And How The U S Compares The Washington Post

Employee Leave Of Absence What You Need To Know Adp

Americans Could Finally Get Paid Family Leave But Who Pays Time